IF YOUR PAYROLL IS STATUTORY COMPLIANCE

The XEAM VENTURES Team works with 500+ National and International businesses all across India, UK, USA helping with everything from payroll to attendance to compliance management. We have created a checklist to help you easily analyze if your Payroll is statutory compliant.

1. Is my company registered for Provident Fund?

The Provident Fund is a saving tool that helps employees save a part of their income. To stay compliant to the EPFO’s rules and regulations, any company that has grown to a number of 20 or more employees is required to be registered for Provident Fund. Failure to comply with EPFO’s norms, the company will be charged with heavy penalties.

2. Is my organization to adhering to Minimum Wages?

Minimum Wages are fixed under the Minimum Wages Act, 1948. The minimum wage rates are determined by both the Central Government & State Government. The rates are also determined on occupation, sector, and type of employee.

According to the Minimum Wage Act, the employer is obliged to pay wages on a timely basis at least once a month.

3. Have I included Gratuity as part of my employees’ CTC?

As per the Payment of the Gratuity Act, 1972, Gratuity is applicable to all establishments including NGOs, educational institutes and hospitals with an employee size of 10 or more. Since gratuity is a fixed contribution from the company’s side, it is shown as part of the CTC. Thus making Gratuity part of the employees’ CTC is necessary.

4. Have I made necessary deductions such as TDS and Professional Taxes

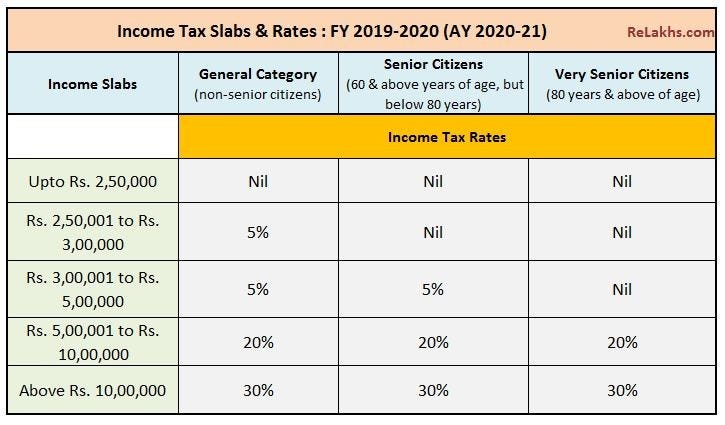

TDS (Tax Deducted at Source) is deducted is a means of indirect tax collection according to the Income Tax Act, 1961. This TDS rule directs employers to deduct a certain amount of tax before full payment to the receiver. TDS rule is applicable only if the employee falls under the Income Tax Slab.

All these Points help you to easily analyze if your Payroll is statutory compliance.

Comments

Post a Comment